Quarterly Updates

2018

Fourth Quarter 2018 Operating Highlights

Following the completion of the Company’s preliminary economic assessment (“PEA”) on the Filo del Sol Project in 2017, the Company proceeded with next phase engineering studies during the year ended December 31, 2018, with the support and undertaking of a PFS on the project by Ausenco Engineering Canada Inc.

During the latter half of the year, the Company focused on completion of metallurgical analyses and other PFS testwork disciplines, and their incorporation into the study. The PFS was substantially completed during the fourth quarter of 2018, and its results were announced by the Company on January 13, 2019. The completed PFS continues to support the Company’s assertions that the Filo del Sol Project exhibits strong economics and remarkable potential, which are highlighted by:

- a US$ 1.28 billion after-tax NPV using a discount rate of 8% and an IRR of 23%, at US$ 3.00/lb copper, US$ 1,300/oz gold, and US$ 20/oz silver;

- average annual production of approximately 67,000 tonnes of copper (including copper as copper precipitate), 159,000 ounces of gold, and 8,653,000 ounces of silver at a C1 cost of US$ 1.23/lb copper equivalent;

- pre-production capital costs totaling US$ 1.27 billion (excluding costs prior to a construction decision);

- a 14 year mine life (including pre-stripping), producing almost 1.75 million pounds of copper as cathode, and 1.92 million ounces of gold and 104 million ounces of silver as doré, over the 13 year leach feed schedule, with additional copper recovered as high-grade copper precipitate; and

- a low strip ratio of 1.5:1.

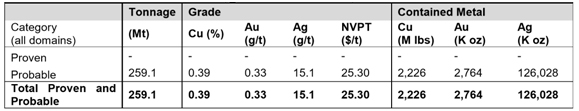

The PFS also introduced an initial Mineral Reserve estimate for the Filo del Sol project, which, at a 0.01 US$/tonne Net Value per Tonne (“NVPT”) cut-off, is as follows:

Notes to accompany Filo del Sol Mineral Reserves table:

- Mineral Reserves have an effective date of 13 January 2019. The Qualified Person for the estimate is Mr. Jay Melnyk, P.Eng. of AGP Mining Consultants, Inc.

- The Mineral Reserves were estimated in accordance with the CIM Definition Standards for Mineral Resources and Reserves;

- The Mineral Reserves are supported by a mine plan, based on a pit design, guided by a Lerchs Grossmann (LG) pit shell. Inputs to that process are:

- Metal prices of Cu $3.00/lb, Ag $20/oz, Au $1300/oz;

- Mining cost of $2.00/t;

- An average processing cost of $9.73/t;

- General and administration cost of $2.02/t processed;

- Pit slope angles varying from 29 to 45 degrees, inclusive of geotechnical berms and ramp allowances;

- Process recoveries were based on rocktype. The average recoveries applied were 83% for Cu, 73% for Au and 80% for Ag, which exclude the adjustments for operational efficiency and copper recovered as precipitate which were included in the financial evaluation;

- Dilution and Mining Loss adjustments were applied at ore/waste contacts using a mixing zone approach. The volumes of dilution gain and ore loss were equal, resulting reductions in grades of 1.0%, 1.3% and 1.0% for Cu, Au and Ag respectively;

- Ore/Waste delineation was based on a Net Value Per Tonne (NVPT) breakeven cut-off considering metal prices, recoveries, royalties, process and G&A costs as per LG shell parameters stated above;

- The life-of-mine (LOM) stripping ratio in tonnes is 1.52:1;

- All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines.

The PFS contemplates mining through conventional open pit methods, using a fully autonomous haul truck fleet, and sequential heap leaching, with only the deposit’s oxide material incorporated into the study. The underlying copper-gold sulphide structure has not been fully tested nor included in any study or project economics to date, and represents potentially significant upside for the Filo del Sol Project, along with:

- improving metallurgical recoveries with additional test work and optimization of process parameters; and

- delineating more or higher-grade material through continued exploration of the Company's extensive land package, of which only approximately 20% has been explored to date.

Due to the timing of completion of the PFS, the Company did not have adequate information to plan for the undertaking of a feasibility study at the Filo del Sol Project during the 2018/2019 field season, which began in October 2018. Nonetheless, the Company did incorporate into the 2018/2019 field program certain then known and anticipated informational requirements for the next phase of engineering study, such as the undertaking of hydrogeological testwork and ongoing environmental assessments, which should provide a head start and facilitate the eventual undertaking of a feasibility study in the future.

Therefore, to continue enhancing the project and to maximize utilization of the field camp and personnel during this gap between engineering studies, the Company has been testing the Filo del Sol Project’s extensive exploration potential, with a focus on drilling below the current resource to test the potential for a copper porphyry system. Diamond core drilling for the 2018/2019 field season began in November 2018, and the assay results for the first two completed holes have now been received, as disclosed on March 18, 2019.

The encouraging results confirm the Company’s speculations that the current Mineral Resource is underlain by significant porphyry copper-gold mineralization, which extends to depths of over 1,000 metres below surface. Hole FSDH025, located completely outside of the current Mineral Resource, was drilled to a depth of 1,025 metres and returned grades of 0.30% copper, 0.22 g/t gold, and 1.6 g/t silver, including 132.0 metres at 0.48% copper, 0.30 g/t gold, and 1.2 g/t silver. Hole FSDH026 was drilled 500 metres to the south to a total depth of 613.9 metres, with the first 200 metres passing through the current Mineral Resource. Assays for FDSH026 yielded grades of 0.39% copper, 0.34 g/t gold, and 1.6 g/t silver, including 460.0 metres at 0.45% copper, 0.34 g/t gold, and 1.6 g/t silver. Both holes ended in mineralization and remain open to depth and laterally.

Assays are in progress for the third completed hole, and four additional diamond core holes are still in progress at the Filo del Sol Project, which are scheduled to be completed by the end of March 2019.

CORPORATE UPDATE

Credit Facilities

On January 12, 2018, the Company obtained an unsecured US$ 2.0 million short-term credit facility (the “Initial Facility”) from Zebra Holdings and Investments S.à.r.l (“Zebra”), an insider of the Company, to provide additional financial flexibility to fund ongoing exploration at the Filo del Sol Project and general corporate purposes. Zebra reports its security holdings in the Company as a joint actor with Lorito Holdings S.à.r.l., and at the time of entering into the Initial Facility, they collectively held more than 20% of the Company’s issued and outstanding common shares. Zebra received 6,000 common shares of the Company upon execution of the Initial Facility, and an additional 300 common shares each month, for every US$ 50,000 in principal outstanding on the Initial Facility, prorated accordingly for the number of days outstanding. The Initial Facility matured on January 12, 2019, and a total of 24,222 common shares have been issued to Zebra pursuant thereto, with no interest paid in cash.

On January 12, 2019, simultaneously with the maturing of the Initial Facility, the Company obtained an unsecured US$ 5.0 million credit facility (the “Replacement Facility”) from Zebra, which replaced the Initial Facility, and into which any outstanding balance owed by the Company under the Initial Facility was transferred. In addition, on February 28, 2019, the Company obtained an additional unsecured US$ 5.0 million short-term credit facility (the “Additional Facility”) from Zebra. Through the Replacement Facility and Additional Facility, the Company now has access to US$ 10.0 million, which will be used, as necessary, to fund ongoing exploration at the Filo del Sol Project and for general corporate purposes. The maturity dates of the Replacement Facility and the Additional Facility are July 12, 2020, and February 28, 2020, respectively, with no interest payable in cash during their respective terms.

As consideration, the Replacement Facility and Additional Facility each grant Zebra the right to receive 300 common shares each month, for every US$ 50,000 in principal outstanding under the respective facilities, prorated accordingly for the number of days outstanding. In addition, upon execution of the Additional Facility, Zebra received 6,000 common shares of the Company. As of the date of this MD&A, a total of 43,313 common shares have been issued to Zebra pursuant to the terms of the Replacement Facility and the Additional Facility.

All common shares issued in conjunction with the aforementioned credit facilities are subject to a four-month hold period under applicable securities laws.

OUTLOOK

The completion of a PFS at the Filo del Sol Project in January 2019 marked another significant project milestone. The study, which is highlighted by an after-tax NPV of US$ 1.28 billion at an 8% discount rate and an IRR of 23%, continues to confirm the Company’s views that its flagship asset bolsters significant size, scope, and economic potential. The Company is now analyzing the results and recommendations arising from the PFS to assess its next steps with respect to advancing the project, which may include the undertaking of a feasibility-level study, as appropriate. That being said, even during this evaluation and assessment period, the Company is still progressing with certain feasibility-level testwork during the 2018/2019 field season, which should facilitate to the eventual undertaking of a feasibility study in the future, such as conducting hydrogeological testwork to confirm an industrial source of water for the project, as well as ongoing environmental baseline studies.

Nonetheless, the Company also remains cognisant of the fact that all studies and economic analyses completed to date on the Filo del Sol Project incorporate only the oxide portion of the current resource. With a largely undefined sulphide structure underlying the oxide material, as well as the Company’s considerable land package, of which less than 20% has been explored to date, the Company elected to simultaneously dedicate some resources to test the exploration potential at the Filo del Sol Project during the 2018/2019 field season.

Accordingly, diamond core drilling began at the Filo del Sol Project in November 2018, with a focus on evaluating the sulphide mineralization, which sits below the oxide layers of the current deposit. The first batch of assay results, related to the first two completed holes of this drill campaign, were released on March 18, 2019, and confirm the existence of a much larger copper-gold porphyry system underlying the current Mineral Resource as incorporated into the PFS. The first two holes, which end in mineralization, are highlighted respectively by 1,025 metres at 0.30% copper, 0.22 g/t gold, and 1.6 g/t silver, and 613.9 metres 0.39% copper, 0.34 g/t gold, and 1.6 g/t silver.

Assays are in progress for a third completed hole, and diamond drilling continues at the Filo del Sol Project with four additional diamond holes as part of the 2018/2019 field campaign, scheduled for completion by the end of March 2019. Additional assays will be released as they become available.

Third Quarter 2018 Operating Highlights

In August 2018, the Company successfully completed an update to the Mineral Resource estimate for the Filo del Sol Project, with an effective date of June 11, 2018. The Mineral Resource update is highlighted by a significant increase in the Indicated Resource tonnes and contained metals, which is summarized as follows:

- Total Indicated Resource tonnes increased by 14% to 425.1 million tonnes;

- Total Indicated contained gold in all zones increased by 12% to 4.4 million ounces;

- Total Indicated contained copper in all zones increased by 12% to 3.1 billion pounds; and

- Total Indicated contained silver in all zones increased by 34% to 147 million ounces.

This increase in tonnage and contained metals in the Indicated Resource category marks the attainment of a key objective of the Company's 2017/2018 drill program, which was to significantly increase the amount of material available for inclusion in the PFS, as appropriate. Seventy-one percent (71%) of the total updated Mineral Resource is now within the Indicated category.

Consistent with the previous Mineral Resource estimate, the updated Mineral Resource estimate is comprised of four distinct mineral zones: an uppermost gold oxide ("AuOx") zone, a copper-gold oxide ("CuAuOx") zone, and a silver zone, all of which is underlain by a copper-gold sulphide ("Sulphide") zone. The updated Mineral Resource estimate, segregated by zone, is summarized in the following table.

Zone |

Cutoff |

Category |

Tonnes |

Cu |

Au |

Ag |

lbs Cu |

Ounces Au |

Ounces Ag |

(millions) |

(%) |

(g/t) |

(g/t) |

(millions) |

(thousands) |

(thousands) |

|||

AuOx |

0.20 g/t Au |

Indicated |

49.9 |

0.04 |

0.42 |

3.0 |

45 |

679 |

4,810 |

Inferred |

20.8 |

0.08 |

0.34 |

2.4 |

35 |

226 |

1,580 |

||

CuAuOx |

0.15 % CuEq |

Indicated |

259.2 |

0.38 |

0.29 |

2.7 |

2,166 |

2,385 |

22,500 |

Inferred |

74.3 |

0.29 |

0.31 |

2.1 |

481 |

735 |

5,040 |

||

Ag |

20 g/t Ag |

Indicated |

40.5 |

0.50 |

0.43 |

87.6 |

446 |

562 |

114,180 |

Inferred |

8.8 |

0.36 |

0.43 |

79.3 |

70 |

121 |

22,400 |

||

Sulphide |

0.30 % CuEq |

Indicated |

75.5 |

0.27 |

0.34 |

2.2 |

451 |

813 |

5,370 |

Inferred |

71.2 |

0.30 |

0.33 |

2.5 |

470 |

750 |

5,740 |

||

Total |

Indicated |

425.1 |

0.33 |

0.32 |

10.7 |

3,108 |

4,439 |

146,860 |

|

Inferred |

175.1 |

0.27 |

0.33 |

6.2 |

1,056 |

1,832 |

34,760 |

||

1 – CuAuOx copper equivalent (CuEq) assumes metallurgical recoveries of 82% for copper, 55% for gold and 71% for silver based on preliminary metallurgical testwork, and metal prices of US$3/lb copper, US$1300/oz gold, US$20/oz silver. The CuEq formula is: CuEq=Cu+Ag*0.0084+Au*0.4239;

2 – Sulphide copper equivalent (CuEq) assumes metallurgical recoveries of 84% for copper, 70% for gold and 77% for silver based on similar deposits, as no metallurgical testwork has been done the Sulphide mineralization, and metal prices of US$3/lb copper, US$1300/oz gold, US$20/oz silver. The CuEq formula is: CuEq=Cu+Ag*0.0089+Au*0.5266;

3 – The Qualified Person for the resource estimate is James N. Gray, P.Geo. of Advantage Geoservices Ltd.;

4 – All figures are rounded to reflect the relative accuracy of the estimate; 5 – Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability; 6 – The resource was constrained by a Whittle® pit shell using the following parameters: Cu $3/lb, Ag $20/oz, Au $1300/oz, slope of 45°, a mining cost of $2.50/t and an average process cost of $13.26/t.

The updated Mineral Resource estimate will form the basis of the PFS, which is currently underway and will consider only the AuOx, CuAuOx, and silver zones in the context of leach-only scenarios. For further information concerning the updated Mineral Resource estimate for the Filo del Sol Project, please refer to the Company's news release dated August 8, 2018.

OUTLOOK

The Company continues to work towards completion of the PFS, which is being led by Ausenco Engineering Canada Inc. and is targeted for completion by the first quarter of 2019. The PFS will incorporate the updated Mineral Resource estimate and will explore several opportunities to enhance the value of the Filo del Sol Project, as identified in the PEA, including:

- Evaluating opportunities to optimize the mine plan and production schedules by smoothing out the production profile and bringing forward copper revenues; and

- Increasing metallurgical recoveries with further test work and optimization.

The refinement of metallurgical recoveries, which is deemed a key area of focus and value creation for the Filo del Sol Project, began in April 2018, using material collected during the 2017/2018 field program. This current phase of metallurgical testwork is now nearing completion and the results will be incorporated into the PFS.

With the completion of an updated Mineral Resource estimate and the metallurgical testwork program progressing as scheduled, the PFS is on target for completion by the first quarter of 2019, which will be the next landmark for the Company's continuing advancement of the Filo del Sol Project. In advance of receiving the PFS results, which will guide the necessary steps to undertaking a feasibility study on the project, the Company has planned its 2018/2019 field program around certain known or anticipated informational requirements for feasibility-level studies, such as the need to conduct hydrogeological testwork to confirm a source of water for the project. Data generated through this advance work should facilitate the eventual undertaking of a feasibility study in the future. In addition, to maximize utilization of the field camp and personnel during the season, the 2018/2019 field program also plans to test the project's significant exploration upside. As mentioned, to date, only approximately 20% of the project area has been explored, the current resource remains open for expansion, and there is potential for a copper porphyry system below the current resource. Preparations for this upcoming field program are currently underway, and results are expected to be available in the first and second quarters of 2019.

Second Quarter 2018 Operating Highlights

Following completion of an extensive field and drill program at the Filo del Sol Project at the end of March 2018, the Company focused on advancing samples collected through testing and analysis during the second quarter. The complete assay results of this program, which consisted of 9,411 metres in 31 reverse circulation ("RC") holes and 9 diamond drill holes, were received during the second quarter of 2018 and were highlighted by:

Hole ID |

Drill Hole Intersection |

Purpose |

VRC135 |

20 metres @ 0.54% Cu, 0.96 g/t Au, 208.0 g/t Ag |

Resource conversion |

VRC152 |

38 metres @ 0.33% Cu, 0.28 g/t Au, 313.6 g/t Ag |

Resource conversion |

VRC155 |

50 metres @ 0.56% Cu, 0.50 g/t Au, 236.4 g/t Ag |

Resource conversion |

VRC163 |

180m @ 0.54% Cu, 0.40 g/t Au, 3.0 g/t Ag (including 64m @ 1.10% Cu, 0.69 g/t Au, 1.8 g/t Ag) |

Resource conversion |

VRC164 |

126m @ 0.65% Cu, 0.82 g/t Au, 54.6 g/t Ag |

Resource conversion |

FSDH017A |

88m @ 0.95% Cu, 0.19 g/t Au, 43.4 g/t Ag |

Resource conversion and addition |

FSDH021 |

141m @ 0.98% Cu, 0.30 g/t Au, 56.7 g/t Ag |

Infill and metallurgy |

FSDH022 |

130m @ 1.25% Cu, 0.28 g/t Au, 1.5 g/t Ag; (including 26m @ 4.98% Cu, 0.30 g/t Au, 0.7 g/t Ag) |

Infill and geotechnical |

FSDH023 |

72m @ 1.02% Cu, 0.26 g/t Au, 108.5 g/t Ag; |

Infill and metallurgy |

Based on the complete assay results from the 2017/2018 field program, the Company successfully updated the Mineral Resource estimate for the Filo del Sol Project with an effective date of June 11, 2018. The Mineral Resource update is highlighted by a significant increase in the Indicated Resource tonnes and contained metals, which accomplishes a key objective of the Company's 2017/2018 drill program. These increases are summarized as follows:

- Total Indicated Resource tonnes increased by 14% to 425.1 million tonnes;

- Total Indicated contained gold in all zones increased by 12% to 4.4 million ounces;

- Total Indicated contained copper in all zones increased by 12% to 3.1 billion pounds; and

- Total Indicated contained silver in all zones increased by 34% to 147 million ounces.

This resource update replaces the resource estimate released on August 21, 2017 and is comprised of four distinct mineral zones: an uppermost gold oxide ("AuOx") zone, a copper-god oxide ("CuAuOx") zone, and a silver zone, all of which is underlain by a copper-gold sulphide ("Sulphide") zone. The updated Mineral Resource estimate, segregated by zone, is summarized in the following table.

Zone |

Cutoff |

Category |

Tonnes |

Cu |

Au |

Ag |

lbs Cu |

Ounces Au |

Ounces Ag |

(millions) |

(%) |

(g/t) |

(g/t) |

(millions) |

(thousands) |

(thousands) |

|||

AuOx |

0.20 g/t Au |

Indicated |

49.9 |

0.04 |

0.42 |

3.0 |

45 |

679 |

4,810 |

Inferred |

20.8 |

0.08 |

0.34 |

2.4 |

35 |

226 |

1,580 |

||

CuAuOx |

0.15 % CuEq |

Indicated |

259.2 |

0.38 |

0.29 |

2.7 |

2,166 |

2,385 |

22,500 |

Inferred |

74.3 |

0.29 |

0.31 |

2.1 |

481 |

735 |

5,040 |

||

Ag |

20 g/t Ag |

Indicated |

40.5 |

0.50 |

0.43 |

87.6 |

446 |

562 |

114,180 |

Inferred |

8.8 |

0.36 |

0.43 |

79.3 |

70 |

121 |

22,400 |

||

Sulphide |

0.30 % CuEq |

Indicated |

75.5 |

0.27 |

0.34 |

2.2 |

451 |

813 |

5,370 |

Inferred |

71.2 |

0.30 |

0.33 |

2.5 |

470 |

750 |

5,740 |

||

Total |

Indicated |

425.1 |

0.33 |

0.32 |

10.7 |

3,108 |

4,439 |

146,860 |

|

Inferred |

175.1 |

0.27 |

0.33 |

6.2 |

1,056 |

1,832 |

34,760 |

||

1 – CuAuOx copper equivalent (CuEq) assumes metallurgical recoveries of 82% for copper, 55% for gold and 71% for silver based on preliminary metallurgical testwork, and metal prices of US$3/lb copper, US$1300/oz gold, US$20/oz silver. The CuEq formula is: CuEq=Cu+Ag*0.0084+Au*0.4239;

2 – Sulphide copper equivalent (CuEq) assumes metallurgical recoveries of 84% for copper, 70% for gold and 77% for silver based on similar deposits, as no metallurgical testwork has been done the Sulphide mineralization, and metal prices of US$3/lb copper, US$1300/oz gold, US$20/oz silver. The CuEq formula is: CuEq=Cu+Ag*0.0089+Au*0.5266;

3 – The Qualified Person for the resource estimate is James N. Gray, P.Geo. of Advantage Geoservices Ltd.;

4 – All figures are rounded to reflect the relative accuracy of the estimate;

5 – Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability;

6 – The resource was constrained by a Whittle® pit shell using the following parameters: Cu $3/lb, Ag $20/oz, Au $1300/oz, slope of 45°, a mining cost of $2.50/t and an average process cost of $13.26/t.

The updated Mineral Resource estimate will form the basis of the PFS, which is currently underway. For further information concerning the updated Mineral Resource estimate for the Filo del Sol Project, please refer to the Company's news release dated August 8, 2018 available under the Company's profile on SEDAR at www.sedar.com.

Diamond drilling completed during the 2017/2018 field program, as well as surface trenching, also provided samples for geotechnical and metallurgical testwork, which will form an integral part of the PFS on the Filo del Sol Project. The PFS metallurgical testwork program is being carried out at SGS Minerals Services' lab in Lakefield, Ontario and commenced in early April, 2018.

First Quarter 2018 Operating Highlights

Completion of 2017/2018 Field Program

The Company’s key operating focus for the three months ended March 31, 2018 was the completion of its 2017/2018 field program at the Filo del Sol Project, which occurred at the end of March 2018, coinciding with the end of the South American field season. Over its duration, the Company successfully drilled a total of 9,411 metres in 31 reverse circulation (“RC”) holes and 9 diamond drill holes. The assay results for the first 20 RC holes have been received and include the following highlights:

- VRC135: 20 metres @ 0.54% Cu, 0.96 g/t Au, 208.0 g/t Ag;

- VRC137: 164 metres @ 0.33% Cu, 0.36 g/t Au, 27.4 g/t Ag;

- VRC143: 36 metres @ 1.45% Cu, 0.34 g/t Au, 0.9 g/t Ag;

- VRC152: 38 metres @ 0.33% Cu, 0.28 g/t Au, 313.6 g/t Ag;

- VRC153: 12 metres @ 0.86% Cu, 1.91 g/t Au, 0.8 g/t Ag; and

- VRC155: 50 metres @ 0.56% Cu, 0.50 g/t Au, 236.4 g/t Ag.

With the field work performed and results received to date, the Company expects to achieve its goal of converting a portion of the Inferred oxide resource to the Indicated category, while step out drilling appears to have extended mineralization beyond the current limits of the Mineral Resource. In addition, over 4.5 tonnes of material has been collected during this past field season, which will be used for metallurgical, geotechnical and environmental testwork, all of which was undertaken in support of the Pre-Feasibility Study (“PFS”), which is currently underway.

CORPORATE UPDATE

Credit Facility

On January 12, 2018, the Company obtained an unsecured US$ 2.0 million short-term credit facility (the “Facility”) from Zebra Holdings and Investments S.à.r.l (“Zebra”), an insider of the Company, to provide additional financial flexibility to fund ongoing exploration at the Filo del Sol Project and general corporate purposes. Zebra reports its security holdings in the Company as a joint actor with Lorito Holdings S.à.r.l., and at the time of entering into the Facility they collectively held more than 20% of the Company’s issued and outstanding common shares. Zebra received

6,000 common shares of the Company upon execution of the Facility, and an additional 300 common shares each month, for every US$ 50,000 in principal outstanding on the Facility, prorated accordingly for the number of days outstanding. There is no interest payable in cash during the term of the Facility, and all common shares issued in conjunction with the Facility are subject to a four-month hold period under applicable securities laws.

The Company drew a total of US$ 1.7 million against the Facility, which was fully repaid on February 28, 2018 following closing of a bought-deal equity financing and concurrent non-brokered private placement (see section below). The Facility remains available until January 12, 2019, and as of the date of this MD&A, the Company has issued a total of 12,300 common shares to the lender as consideration for providing the Facility to the Company.

Closing of Financings for $25.5 Million

On February 28, 2018, the Company closed the sale of 5,894,231 common shares of the Company on a bought deal basis to a syndicate of underwriters led by Haywood Securities Inc. (the “Underwriters”), at a price of $2.60 per share (the “Issue Price”) for total gross proceeds of approximately $15.3 million (the “Offering”), which included 124,231 common shares issued on partial exercise of an over-allotment option. The gross proceeds generated from the Offering were subject to a 5.0% commission, payable in cash.

On February 28, 2018, the Company also closed a concurrent private placement of 3,928,964 common shares, including 82,810 common shares issued to adjust for the Underwriters’ partial exercise of the Over-allotment Option, at the Issue Price, for gross proceeds of approximately $10.2 million (the “Concurrent Private Placement”).

The Company plans to use the net proceeds from the Offering and Concurrent Private Placement for exploration and development at the Filo del Sol Project, and for working capital and general corporate purposes. A portion of the net proceeds have also been used to repay the amounts drawn under the Facility.

OUTLOOK

As of the date of this MD&A, assay results from only the first 20 RC holes of the 2017/2018 drill program have been received and the remaining assay results, covering 11 RC and 9 diamond drill holes, are expected to become available before the end of the second quarter. The results of the 2017/2018 drill program, once received in full, will form the basis for an update to the Mineral Resource estimate on the Filo del Sol Project, which is currently planned for completion during the third quarter, 2018.

The updated Mineral Resource estimate, together with the results of the other data collection and testwork disciplines undertaken during the 2017/2018 field program, will be incorporated into a PFS of the Filo del Sol Project, which is being led by Ausenco Engineering Canada Inc., and targeted for completion by the first quarter of 2019. The PFS will explore several opportunities identified in the PEA for unlocking value at the Filo del Sol Project, including:

- Evaluating unique processing methods to take advantage of the fast leach kinetics noted in metallurgical testwork completed to date, which could reduce project capital by recovering soluble copper through installing a conventional washing system for process feed after the crushing circuit. Further study of this option is planned and, if successful, the washing stage could eliminate the permanent copper and on/off leach pads and their associated materials handling systems, saving on capital and operating costs associated with these installations;

- Evaluating opportunities to optimize the mine plan and production schedules by smoothing out the production profile and bringing forward copper revenues; and

- Increasing metallurgical recoveries with further test work and optimization.

The analysis of alternative processing options and refinement of metallurgical recoveries is currently underway, using material collected during the 2017/2018 field program from diamond drill holes and surface trenches. The results of this current phase of metallurgical testwork are expected to be available in the third quarter of 2018.

With the recently completed PEA and a PFS currently underway on the Filo del Sol Project, together with a treasury of $18.1 million at March 31, 2018, the Company is well positioned to make strides towards advancing the Filo del Sol Project. The results of the PFS will guide the direction taken by the Company with respect to the Filo del Sol Project and may lead to further advanced studies of the Project.

2017

Fourth Quarter 2017 (YE) Operating Highlights

The Company achieved several key operating milestones for the Filo del Sol Project during the year ended December 31, 2017, most notably the successful completion of the 2016/2017 field program in March, an update of the Mineral Resource estimate in August, the completion of the second phase of metallurgical testwork in September, and the finalization of a PEA on the Project to cap off the year. The 2017/2018 field program which is intended to collect data in support of a Preliminary Feasibility Study was initiated prior to the end of the year.

Completion of PEA

Supported by the positive milestones achieved during 2017, the Company commissioned the undertaking of a formal, independent PEA of the Filo del Sol Project. The PEA was completed in November 2017 by SRK and contemplated the updated Mineral Resource estimate, using open-pit mining and heap leach processing of only the oxide portions of the Resource. The results of the PEA demonstrate robust project economics for the Project, which are highlighted by the following:

- Estimated after-tax NPV of US$ 705 million using an 8% discount rate and an estimated IRR of 23%;

- Estimated pre-production capital cost of US$ 792 million, including US$ 71 million in capitalized pre-stripping;

- Average estimated annual production of approximately 50,000 tonnes of copper, 115,000 ounces of gold, and over 5 million ounces of silver per year;

- Estimated Life of Mine revenue split approximately 56% copper, 26% gold, and 18% silver;

- Robust resource, with most of the mine plan derived from Indicated Mineral Resources (79%);

- Open pit mining followed by heap leach processing to produce copper cathode and gold-silver doré; and

- Excellent metallurgy and fast leach kinetics provide unique processing opportunities

For further details, please refer to the Company’s news release dated November 28, 2017.

The PEA is preliminary in nature and is partly based on Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the preliminary assessment based on these Mineral Resources will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The Technical Report, which summarizes the results of the PEA, is available for review under the Company's profile on SEDAR at www.sedar.com and on the Company's website at www.filo-mining.com.

Initiation of the 2017/2018 Field Program

A planned 10,000 metre drill program designed to upgrade Inferred resources to the Indicated category and provide additional samples for metallurgical testwork and geotechnical characterization of the planned open pit was initiated on December 16, 2017.

OUTLOOK

In November 2017, the Company initiated the work program at the Filo del Sol Project for the 2017/2018 field season, which coincides with the South American summer. This program is based on recommendations from the PEA and will collect the data required to support the undertaking of a Pre-Feasibility Study (“PFS”), which was launched in January 2018, and is targeted for completion by the first quarter of 2019. The Company has engaged Ausenco Engineering Canada Inc. to lead the PFS.

The current design of the field work program includes reverse circulation and diamond drilling for resource conversion, metallurgical sample collection and geotechnical information, as well as infrastructure site investigations and ongoing metallurgical and environmental studies. In addition, the PEA highlighted several opportunities for unlocking value at the Filo del Sol Project, which will be explored by the Company during the PFS, such as:

- Evaluating unique processing opportunities to take advantage of the fast leach kinetics noted in metallurgical testwork completed to date, which could reduce project capital by recovering soluble copper through installing a conventional washing system for process feed after the crushing circuit. Further study of this option is planned and, if successful, the washing stage could eliminate the permanent copper and on/off leach pads and their associated materials handling systems, saving on capital and operating costs associated with these installations;

- Optimizing the mine plan and production schedules by evaluating opportunities to smooth production and bring forward copper revenues;

- Increasing metallurgical recoveries with further test work and optimization; and

- Delineating more or higher-grade material through continued exploration on the Company's extensive land package. The deposit remains open in most directions with several additional exploration targets outside of the immediate deposit area that have seen only preliminary exploration work. In addition, there are areas to cover near the deposit that have not been drill tested and are prospective for additional discoveries.

With the recently completed PEA and a PFS currently underway on the Filo del Sol Project, together with a treasury replenished by the $25.5 million financings discussed above, the Company is well position to make strides towards advancing the Filo del Sol Project. The results of the PFS will guide the direction taken by the Company with respect to the Filo del Sol Project and may lead to further advanced studies of the Project.

Third Quarter 2017 Operating Highlights

The Company completed two key programs during the third quarter of 2017: an update to the Mineral Resource estimate for the Filo del Sol Project and completion of the second phase of metallurgical testwork. Filo Mining incorporated the results of these two programs into an internal concept study of development options for the Project, which ultimately supported the undertaking of a formal preliminary economic assessment (“PEA”) on the Project. Details on these various third quarter developments are provided below.

Update to Mineral Resource Estimate (see news release dated August 21, 2017)

Following the successful completion of an 8,616 metre drill program in March 2017, the Company reported a significant increase to the Filo del Sol Project’s Mineral Resource estimate. With an effective date of July 1, 2017, the overall Mineral Resource was increased by 61% to 373 million tonnes Indicated, plus 239 million tonnes Inferred, containing 2.8 billion pounds of copper, 4.0 million ounces of gold and 109.9 million ounces of silver in the Indicated category, and 1.4 billion pounds of copper, 2.5 million ounces of gold and 60.0 million ounces of silver in the Inferred category.

With respect to the conversion of Inferred material to the Indicated category, the Company achieved a conversion ratio of 98%, resulting in 61% of the updated Mineral Resource falling within the Indicated category, matching the overall increase to the Mineral Resource itself. Most of the increase in the Mineral Resource comes from the Tamberias zone, which is included in the Mineral Resource estimate for the first time. Tamberias is located 1 kilometer south and is contiguous with the main Filo deposit. In addition, drilling this past season has greatly expanded both the size and grade of the oxide gold mineralization in the Filo deposit to the point where it is now significant enough to report on its own.

More importantly, based on metallurgical testwork completed to date, the Mineral Resource has now been divided into four distinct zones based on metallurgical characteristics, around which process designs have taken place within the scope of the PEA. The uppermost strata is a gold oxide (AuOx) zone, followed by a copper-gold oxide (CuAuOx) zone, both of which may be amenable to heap leach processing. The third layer is a silver (Ag) zone, and lastly, there is an underlying copper-gold sulphide zone.

Details of the updated Mineral Resource estimate are summarized in the following table:

| Zone | Cutoff | Category | Tonnes | Cu | Au | Ag | lbs Cu | Ounces Au | Ounces Ag |

|---|---|---|---|---|---|---|---|---|---|

| (millions) | (%) | (g/t) | (g/t) | (millions) | (thousands) | (thousands) | |||

| AuOx | 0.20 g/t Au | Indicated | 52.5 | 0.05 | 0.42 | 3.0 | 59 | 710 | 5,060 |

| Inferred | 31.7 | 0.08 | 0.36 | 2.4 | 57 | 368 | 2,470 | ||

| CuAuOx | 0.15 % CuEq | Indicated | 175.3 | 0.42 | 0.29 | 2.8 | 1,636 | 1,630 | 15,530 |

| Inferred | 94.7 | 0.30 | 0.30 | 2.3 | 624 | 924 | 6,970 | ||

| Ag | 20 g/t Ag | Indicated | 36.5 | 0.52 | 0.41 | 69.5 | 421 | 485 | 81,600 |

| Inferred | 17.0 | 0.40 | 0.43 | 78.9 | 149 | 235 | 43,130 | ||

| Sulphide | 0.30 % CuEq | Indicated | 108.6 | 0.28 | 0.32 | 2.2 | 658 | 1,129 | 7,690 |

| Inferred | 95.5 | 0.29 | 0.32 | 2.4 | 612 | 983 | 7,420 | ||

|

Total |

Indicated | 372.9 | 0.34 | 0.33 | 9.2 | 2,774 | 3,954 | 109,880 | |

| Inferred | 238.9 | 0.27 | 0.33 | 7.8 | 1,442 | 2,510 | 59,990 | ||

Completion of Second Phase of Metallurgical Testwork (see news release dated September 25, 2017)

Subsequent to positive bottle roll leach results from late 2016, a comprehensive second phase metallurgical testwork program was conducted throughout 2017 by SGS Canada Inc. in Lakefiled, Ontario on behalf of the Company, which was completed during the third quarter of 2017.

The program focused on the testing of gold oxide and copper-gold oxide material collected from the main Filo deposit during the 2016/2017 exploration season under column leaching conditions, as well as material gathered from the silver zone. Testing was conducted separately for each of these three types of mineralization, and highlights are as follows:

Gold Oxide Zone:

| Test Method | Two cyanide column leach tests on material crushed to 1.5” and ¾” |

| Average Recoveries | - Gold: 92.8% - Silver: 69.8% |

| Other Observations | - No significant impacts from varying crush size - Rapid leach kinetics, with over 90% gold recovery within first 15 days |

| Variability Testing Results | Seven coarse bottle roll tests (minus 10 mesh) averaged: - Gold: 92.8% - Silver: 39.0% |

Copper-Gold Oxide Zone:

| Test Method | Two sequential column leach tests on material crushed to 1.5” and ¾” |

| Average Recoveries | - Copper: 81.9% - Gold: 86.7% - Silver: 70.8% |

| Other Observations | - Copper leaching required minimal sulfuric acid; copper in test material often water soluble - Rapid leach kinetics, with over 80% copper recovery within first 15 days of acid leaching, and over 80% gold recovery within first 15 days of cyanide leaching |

| Variability Testing Results | Five sequential coarse bottle roll tests (minus 10 mesh) averaged: - Copper: 92.2% - Gold: 88.2% - Silver: 59.9% |

Silver Zone:

| Test Method | - Sequential bottle roll test1 (minus 10 mesh) |

| Recoveries | - Copper: 60.8% - Gold: 63.5% - Silver: 72.8% |

1 Silver zone material for metallurgical testing was collected from reverse circulation drill cuttings, which were not coarse enough for column testing, and for which only sequential bottle roll testing could be performed.

Undertaking of PEA (see news release dated September 19, 2017)

Supported by the positive milestones achieved during the quarter, as discussed in the preceding sections, the Company commissioned the undertaking of a formal, independent PEA of the Filo del Sol Project. The Company hired SRK Consulting (Canada) Inc. to lead the PEA, which is based on the updated Mineral Resource estimate and contemplates open-pit mining and heap leach processing of the oxide portions of the Resource. The PEA is now substantially completed, and the Company expects to release the results of this independent assessment shortly.

OUTLOOK

Guided by an experienced board of directors and management team, Filo Mining is focused on advancing the Filo del Sol Project. The Company has now substantially completed a PEA on this flagship asset, and the results of this independent assessment will be released shortly.

In addition, the Company has recently begun its next work program for the 2017/2018 field season at the Filo del Sol Project, which coincides with the South American summer. This program, as currently designed, will collect the data anticipated to be required to support the undertaking of a Pre-Feasibility Study (“PFS”) for completion by as early as the end of 2018, should it be decided that such a study be undertaken. The current design of the field work program includes reverse circulation and diamond drilling for resource conversion, metallurgical sample collection and geotechnical information, as well as infrastructure site investigations and ongoing metallurgical and environmental studies. The actual undertaking of a PFS, and the nature and amount of data that would be collected during the 2017/2018 field season to support a PFS, if undertaken, is contingent upon the analysis of, and the recommendations arising from, the PEA.

Second Quarter 2017 Operating Highlights

During the second quarter of 2017, the Company focused on the interpretation of data from the 2016/2017 field program, which focused on infill and step out drilling on the Filo del Sol deposit.

The complete assay results of this program, which consisted of 8,616 metres of reverse circulation drilling in 41 holes, were received during the second quarter of 2017 (see news releases dated April 10, 2017 and May 17, 2017). Select highlights of these results are as follows:

- Drilling expanded and better defined the oxide gold zone of the Filo del Sol deposit, and increased the dimensions of this zone to approximately 700 metres north-south by 350 metres east-west. Highlights from the drilling in oxide gold zone included: 112 metres at 0.73 g/t gold in VRC101 and 42 metres at 1.04 g/t gold in VRC132;

- Better definition of the high-grade copper oxide zone of the Filo del Sol resource. Highlights included: 60 metres at 1.01% copper, including 26 metres at 1.56% copper, in VRC100; and 71 metres at 2.06% copper, including 30 metres at 3.03% copper, in VRC125;

- Confirmation of a high-grade, flat-lying, straitform silver-rich zone underlying the copper oxide zone in most areas of the Filo del Sol deposit. Highlights included: 34 metres at 138.1 g/t silver, including 16 metres at 227.5 g/t silver, in VRC100; and 34 metres at 285.1 g/t silver, including 16 metres at 565.1 g/t silver, in VRC132;

- Follow up drilling at the Filo South target, located approximately 1 km south of the Filo del Sol deposit, has resulted in better definition of this target over an area of 1,000 metres north-south by 500 metres east-west, and demonstrated that it is contiguous with the Filo del Sol deposit. Three new mineralized zones were encountered in this season’s drilling at Filo South:

- A shallow oxide copper zone which is highlighted by intersects of 102 metres at 0.77% copper and 54 metres at 1.01% copper in VRC111, 50 metres at 0.81% copper and 0.41 g/t gold in VRC110, and 66 metres at 0.63% copper in VRC119;

- An oxide gold zone which extends from surface to an average depth of approximately 100 metres, and is highlighted by intersects of 94 metres at 0.56 g/t gold in VRC109, and 100 metres at 0.57 g/t gold, including 28 metres at 0.80 g/t gold in VRC134.

- A new area of copper-gold mineralization, which was initially discovered by hole VRC103, intersecting 40 metres at 1.00% copper and 0.31 g/t gold. Follow up drilling at this location was successful in intersecting 16 metres at 0.87% copper and 0.32 g/t gold in VRC128.

- Approximately 2.8 tonnes of material from the oxide gold and copper zones were collected and submitted to SGS Lakefield’s laboratory for column leach testing, which will provide information on the optimum fragment size for leaching and more information on how the mineralized material will behave on a leach pad.Additional material from drill samples was also submitted for testwork on the silver zone. Completion of the testwork is targeted for the third quarter, 2017.

OUTLOOK

With an experienced board of directors and management team, and a treasury of approximately $7.3 million as at June 30, 2017, Filo Mining is well positioned to advance the Filo del Sol Project.

The Company expects to complete the updated resource estimate for the Filo del Sol Project in the third quarter, 2017. The second phase of metallurgical testwork, which follows up on the encouraging initial results received in October 2016, is also targeted for completion in the third quarter, 2017.

Once the results are received from the current metallurgical test program, the Company will combine the information with the updated Mineral Resource estimate in order to prepare a preliminary internal conceptual study of development options for the Filo del Sol Project. This internal study is expected to be completed towards the end of the third quarter of 2017 and will allow the Company to decide whether to initiate a formal preliminary economic assessment (“PEA”) of the Filo del Sol Project. If a PEA is initiated for the Filo del Sol Project, the related technical report would be targeted for completion by the first quarter of 2018.

First Quarter 2017 Operating Highlight

During the three months ended March 31, 2017, the Company focused on carrying out the 2016/2017 field program, which was aimed at furthering understanding of conceptual development options for the Filo del Sol deposit, while continuing to evaluate the compelling exploration potential of the property.

This program, which was successfully completed in March 2017, included the collection of representative sample material for ongoing metallurgical testing and 8,616 metres of reverse circulation drilling in 41 holes. The objectives of the drill program included conversion of Inferred resources to the Indicated classification, expansion of the current resource, and testing a number of high-quality exploration targets within 2 km of the Filo del Sol deposit, including:

The Filo South target, which is located approximately 1 km south of the deposit. Surface mapping and sampling in this area has defined a northwesterly-trending gold +/- copper bearing zone of strong silicification, quartz vein stockwork and breccia with minimum dimensions of 1,000 metres along strike by 200 metres wide. Wide-spaced historical drilling did not test this zone, however, surface trenching across it in 2016 returned 114 metres of 0.85% copper and 0.35 g/t gold.

The Cerro Vicuña target, a distinct conical hill located 1 km southeast of the deposit, and immediately to the east of the Filo South target. Surface mapping shows this hill to be underlain by a silicified and stockwork porphyry intrusive, the Vicuña Porphyry, with grab samples of up to 5 g/t gold collected from surface. The hill is covered by an extensive copper and gold surface geochemistry anomaly and is characterized by an alteration zonation and geophysical signature characteristic of porphyry deposits. This target had never been previously drilled.

Assay results from 24 of the 41 total drill holes from the 2016/2017 drill program have been received to date, and include the following highlights:

- Confirmation of higher grade zones within the oxide gold zone that forms the upper part of the current resource (see News Release dated February 15, 2017). The assay results include intersects of 84 metres at 1.36 g/t gold in VRC097 and 78 metres at 1.02 g/t gold in VRC099, representing the best and third best gold intersections in the Filo del Sol deposit to date (gold grade times width);

- Expansion of the oxide gold zone of the current Filo del Sol resource, as a result of infill holes (see News Release dated April 10, 2017). Assay results to date have been highlighted by an intersection of 112 metres at 0.73 g/t gold in VRC101;

- Confirmation of the high-grade copper portion of the Filo del Sol resource, with intersections in infill holes of 20 metres at 1.13% copper in VRC097 and 20 metres at 1.91% copper in VRC099; and

- Identification of a potential new zone of shallow oxide copper and gold mineralization at the Filo South target (see News Release dated April 10, 2017). The assay results received to date include intersects of 102 metres at 0.77% copper and 0.35 g/t gold in VRC111, 50 metres at 0.81% copper and 0.41 g/t gold in VRC110, and 66 metres at 0.63% copper and 0.35 g/t gold in VRC119.

CORPORATE UPDATE

The Company appointed Mr. James Beck as the Company’s Vice President, Corporate Development and Projects effective February 1, 2017. Mr. Beck is a registered Professional Engineer in the province of Ontario, holds a Bachelor of Applied Science from Queen's University and an MBA from the University of British Columbia. Mr. Beck also serves as the Vice President, Corporate Development and Projects of NGEx, an exploration company listed on the TSX and Nasdaq Stockholm. Prior to his appointment, Mr. Beck was the Company’s Director, Corporate Development.

OUTLOOK

With an experienced board of directors and management team, and a treasury of approximately $11.6 million as at March 31, 2017, Filo Mining is well positioned to advance the Filo del Sol Project while also remaining flexible and responsive to continuing volatility in the resource sector.

The 2016/2017 exploration program was successfully completed in March 2017 and included 8,616 metres of a mix of infill and exploration drilling in 41 holes. Assay results relating to the first 24 holes have been received (see First Quarter 2017 Operating Highlights section above), and the Company will receive the assay results of the remaining 17 holes in the coming weeks. These new drill results will:

- Allow the Company to update the resource estimate for the Filo del Sol Project;

- Provide better understanding of the geometry and extent of the oxide gold zone of the current resource, which currently measures approximately 700 metres by 250 metres, and remains open to the north; and

- Confirm the potential of the Filo South target, located approximately 1 km south of the Filo del Sol deposit, where the Company has discovered new shallow oxide copper and oxide gold mineralization.

- In addition, Filo Mining is currently conducting a more extensive program of metallurgical testwork to follow up on the encouraging initial results received in October 2016. The Company plans to complete column leach tests which will provide information on the optimum fragment size for leaching and more information on how the mineralized material will behave on a leach pad. This information, together with an updated resource estimate, is expected to provide the information needed for a preliminary internal conceptual study of development options. This internal study is expected to be completed towards the end of the third quarter of 2017 and will allow the Company to decide whether to initiate a formal preliminary economic assessment (“PEA”) of the Filo del Sol Project. If a PEA is initiated for the Filo del Sol Project, the related technical report would be targeted for completion by the end of 2017.